Loan Forgiveness – Other Paths

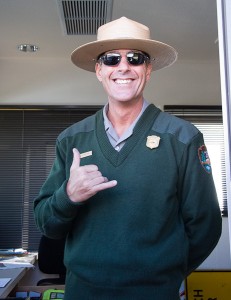

In the last of this series of articles on the many ways you could qualify for College loan forgiveness, we investigate the alternate paths. Many of these alternate paths involve you taking a full time job in Law Enforcement or with a Federal Agency. Fancy yourself a National park ranger or an FBI agent? Read on….

Federal Government Loan Forgiveness Programs

Perkins loans and Stafford Loans can be cancelled for full-time service as a teacher in a designated elementary or secondary school serving students from low-income families, special education teacher (includes teaching children with disabilities in a public or other nonprofit elementary or secondary school), qualified professional provider of early intervention services for the disabled, teacher of math, science, foreign languages, bilingual education, or other fields designated as teacher shortage areas, employee of a public or non-profit child or family service agency providing services to high-risk children and their families from low-income communities, nurse or medical technician, law enforcement or corrections officer, staff member in the educational component of a Head Start Program, service as a Vista or Peace Corps Volunteer and service in the Armed Forces (up to 50% in areas of hostilities or imminent danger).

See also the US Department of Education’s pages onCancellation/Deferment Options for Teachers and Cancellation for Childcare Providers, as well as the Teacher Loan Forgiveness Form.

The US Department of Education maintains a database of low-income schools eligible for teacher loan cancellation for Perkins and Stafford loans.

Secondary school math and science teachers, and elementary/secondary school special education teachers who commit to working in high-need schools for five years can obtain up to $17,500 in Stafford loan forgiveness. They must teach full time for five consecutive years in a qualifying low-income school and be “highly qualified”. (The Taxpayer-Teacher Protection Act of 2004, HR 5186, increased the amount of forgiveness from $5,000 to $17,500 on October 30, 2004.)

Visit the HRSA web site for information on Nursing Education Loan Repayment

The Federal Student Loan Repayment Program allows federal agencies to establish loan forgiveness programs to help recruit and retain employees. This is technically a loan repayment program and not a loan forgiveness program, as the agencies make payments directly to the loan holder and the payments represent taxable income to the employee. The agencies can repay up to $10,000 in Federal student loans per employee per calendar year, with a cumulative maximum of $60,000 per employee. Employees must agree to work for the agency for at least 3 years. For more information, see the Student Loan Repayment Program FAQ. This program is authorized by 5 USC 5379 (alternate link) and 5 CFR 537. Federal Employee Student Loan Assistance Act (P.L. 108-123, 11/11/03) increased the repayment limits to $10,000 per employee per year and $60,000 per employee cumulative. (The federal government’s jobs site is located at www.usajobs.opm.gov. They also have a site focused on jobs for recent graduates ! )

Thank you for joining is on this series.

Data: 2011-2012